Europe has had no shortage of problems in recent months: an uneven economic recovery from COVID-19, countries strained by the omicron outbreak, and now Russian warships massing at the Ukraine border. And these overlapping crises have sent energy prices soaring.

Last July, as the economy recovered from the COVID-19-induced recession, gas prices hit an all-time high of 35 euros per megawatt-hour. By December, they had soared to a whopping 135 euros per megawatt-hour, sending electricity prices across the continent sky-high. Many countries, including the United Kingdom, France, and Spain, have instituted tax breaks and grants to help people pay for electricity and heating.

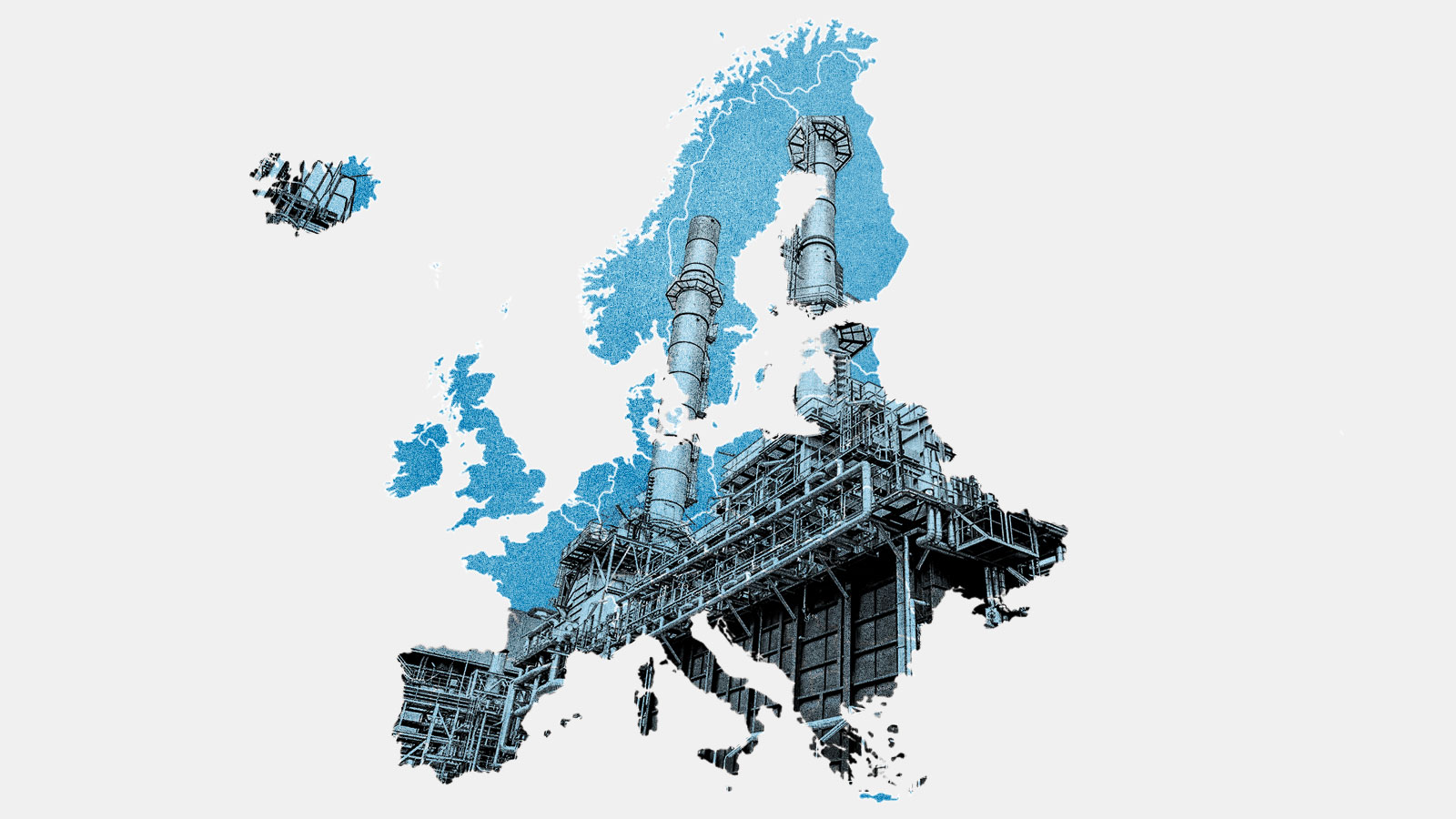

With Russian forces surrounding Ukraine, the situation is poised to get even more dire. Policymakers are facing the possibility that Russia, which provides about 40 percent of the continent’s natural gas, could cut off the flow entirely. If that happens, the European Union would be forced to import even more liquefied natural gas from the United States and abroad — and even that might not be enough to fill the gap.

How did it get to this point? Why are the United Kingdom and the European Union, which have vowed to cut all carbon emissions from their economies by 2050, so dependent on a fossil fuel imported from Russia?

Paradoxically, part of this dependence is a result of the continent’s strategy for getting off fossil fuels. In 1990, Europe produced more than 40 percent of its electricity with coal; by 2019, the dirtiest fossil fuel only produced about 19 percent, with natural gas and renewables picking up the slack. “Coal is on its way out,” said Raphael Hanoteaux, senior policy advisor on gas politics at the European energy think tank E3G in Brussels, Belgium. “And some countries are planning to rely increasingly on gas.”

Natural gas produces fewer carbon dioxide emissions than coal, and can also be counted on to provide reliable energy during the winter months when demand for electricity and heating spikes. But Europe doesn’t make much of it, compared to the world’s biggest producers: the United States, Russia, and Iran. And the European Union’s domestic production of natural gas has been declining steeply, as countries like the Netherlands close down operations over concerns about earthquakes driven by gas extraction.

So Europe has turned to imports to get its natural gas fix — but has run into problems there as well. Natural gas can be imported in two primary ways: through pipelines or via cargo ships if the gas is cooled and transformed into liquefied natural gas, or LNG. (LNG is less than 1/600th of the volume of normal natural gas, which allows ships to carry it overseas.)

During the so-called “gas wars” of the mid- to late-2000s, Russia cut off the supply of natural gas through Ukraine multiple times, rattling European markets and causing policymakers and utilities to look for more stable supplies of both types of imports. The continent built import terminals to convert LNG back into its gaseous form, and also began diversifying its supply of natural gas, pulling the fuel from North Africa, the Middle East, Asia, and the U.S.

According to Nikos Tsafos, the chair of energy and geopolitics at the Center for Strategic and International Studies in Washington D.C., Europe succeeded in diversifying its supply of natural gas to protect against shocks. But that simply wasn’t enough. The combination of a resurgent economy pushing up prices of natural gas, lower-than-normal production from renewable energy in Europe, and Russia not filling Western Europe’s gas storage centers meant that the natural gas system faced stress upon stress. “I hate the term, but it was a perfect storm,” he said.

Part of the problem, Tsafos says, is that natural gas is playing a critical — and difficult — role in Europe’s energy mix. “I like to say that gas gets a failing grade in my book, but gas has the toughest assignment,” he explained. In the wintertime in the U.K., for example, the demand for gas doubles compared to the summertime. That means that the continent either has to store a lot of natural gas, or try to purchase it from abroad during the highest-demand period of the year.

Some say that European policymakers succeeded at diversifying supply — but failed to reduce demand. Over the past decade, “there were new LNG terminals built to reduce dependence on piped gas, and there have been new interconnectors to move LNG across the continent,” said Elisabetta Cornago, a senior research fellow at the Centre for European Reform in Brussels, Belgium. “But when it comes to helping households and businesses invest in energy efficiency, that’s where the pace has been very slow.”

Anne-Sophie Corbeau, a global research scholar at Columbia University’s Center for Global Energy Policy, said that Europe’s poorest citizens are also those living in poorly insulated, drafty houses. They have the biggest energy bills and hurt the most when prices for natural gas spike. (Buildings and homes in Europe have the highest demand for natural gas, followed by the power sector and heavy industry.) But those residents also have the least money available to spend on housing retrofits. “Some people are never going to be able to afford a few thousand euros,” Corbeau said. “It’s as simple as that.”

Some countries are already trying to speed up efforts to use less natural gas. Georg Zachmann, a senior fellow at the Brussels-based think tank Bruegel, says that Germany’s new government is planning to install 6 million heat pumps — which can heat buildings with electricity instead of gas — and push the power sector more toward renewables by 2030. The U.K. government has similarly launched a grant program to encourage households to install heat pumps.

Over the next 10 years, Europe faces a tricky balancing act: how to ensure that there are adequate supplies of natural gas, even while promising to cut the use of the fuel almost entirely. The European Commission has said that the E.U. should cut gas use 30 percent by 2030, compared with 2015 levels, and 96 percent by 2050.

“The bottom line is that the conversion from the short- and medium-term to the long term is going to be bumpy, and no one knows what it looks like yet,” Tsafos said. European utility and energy companies, he says, face a series of complicated questions: Should they secure more steady contracts for natural gas in the short-term, potentially jeopardizing long-term climate goals? Should they invest in gas to insure a steady supply, or turn away from it in favor of renewables?

“If I’m a European utility, and I’m providing gas to Germany or Italy, or Greece or France — well on the one hand I want to supply my customers,” Tsafos said. “On the other hand, I know that at some point I’m not going to be able to sell the thing that I sell today. It’s tough.”

And underlying the entire natural gas crisis is the fear that, if energy prices get too high — even if those high prices are due entirely to the volatility of fossil fuels — it will set off a backlash, turning Europeans against efforts to get rid of fossil fuels. In 2020, the average European paid around 1,200 euros for energy; last year, that number climbed to 1,850 euros. The Yellow Vests protests in France were only a few years ago, and chanting crowds, fires, and street blockades are still burned into the memories of many Europeans. Natural gas, meanwhile, isn’t the only commodity that could cause such an upheaval. Today it might be natural gas or oil; tomorrow it could be lithium for batteries or copper for wind turbines.

“How do we build an energy system in Europe that is decarbonized, stable, and affordable?” Cornago asked. “That’s the big question.”