Two weeks ago, Minnesota’s Public Utilities Commission ratified the first-ever statewide policy for setting a fair and transparent price on solar energy. This week, a coalition of companies that provide leasing contracts for solar to home and business customers declared war on this “value of solar” policy, and pretty much every financial model for compensating solar energy producers that isn’t net metering.

As I’ll outline below, this position by “The Alliance for Solar Choice (a.k.a. solar leasing companies like SolarCity)” leaves one enormous unanswered question.

What’s Happening Right Now

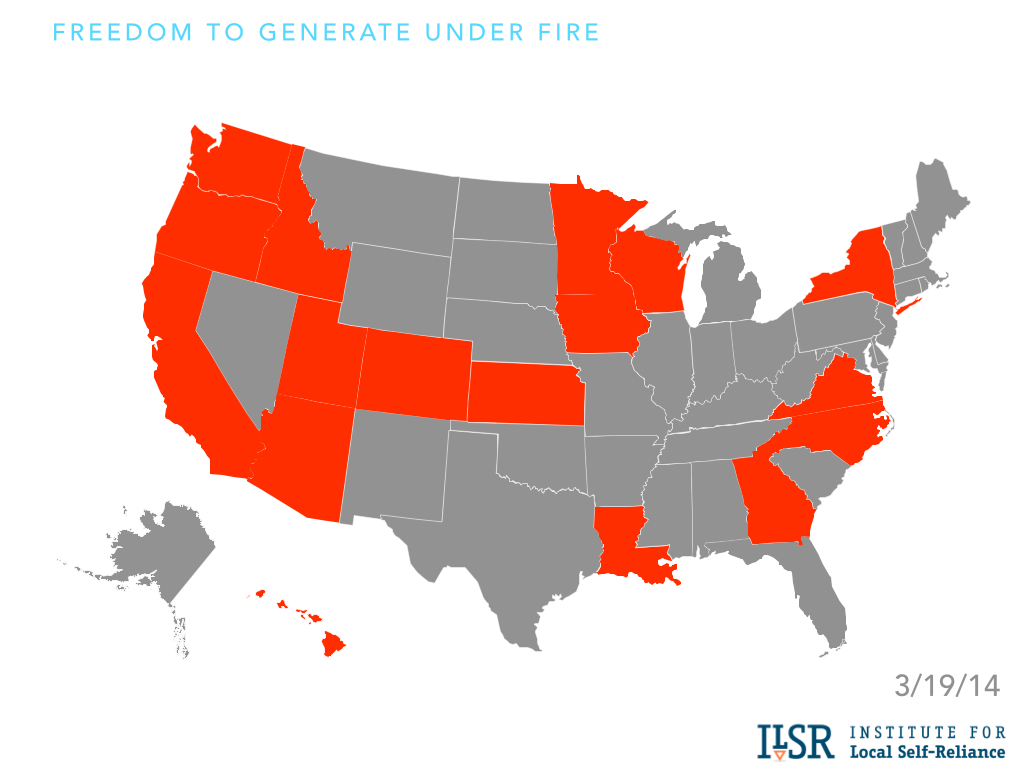

Distributed solar power production is under fire. In nearly 1 of 3 states, utility companies are trying to undermine policies that make it economical to produce energy from a solar panel instead of buying it from a utility.

In nearly every case, the utility offensive is aimed a single policy: net metering. This policy mixes interconnection rules (a technical and administrative set of requirements for connecting to the grid), with economics of billing (net energy metering). Net metering policies typically make it much easier to connect a solar array to the electric grid.

Why Net Metering Matters

The most important piece of net metering is the billing policy that simply compensates solar owners for their energy generation. It spins the meter backward during the day when there is excess solar generation, for example, and forward at night when household energy consumption is higher than solar production. It treats on-site renewable energy production like any other method for reducing energy consumption, by having customers pay for their “net” energy usage (total use less on-site production) on their electricity bill. The following video 101 explains:

Net metering may also reduce extraneous utility charges for “backup” or “standby” power, since such services are typically already covered by a utility’s existing energy reserves.

Without net metering, you’d probably need a battery along with your solar panel. Otherwise, most of your awesome solar energy would be sold to the utility for peanuts while you’re at work. So it’s not the same as being self-reliant. It’s an accounting measure, letting the customer swap their solar electrons for some from the utility, but still pretend that they’re offsetting their own energy use. Real self-reliance (or grid independence) would require a battery, to store surplus solar energy for use at another time.

It may differ from self-reliance, but net metering has been a great investment for ratepayers. When retail electricity prices were low, solar producers were giving valuable peak energy to utilities (and their neighbors) at a substantial discount to its value (see: Minnesota’s Value of Solar). Non-solar customers (e.g. most utility ratepayers) got a good deal. It juiced up thousands of local jobs while driving down the cost of solar like mad. And it’s responsible for a helluva lot of the 13 gigawatts of solar energy powering U.S. homes and businesses in 2014.

What’s Different about Value of Solar or a Feed-In Tariff

The basic idea behind these other policies is to maintain the growth in distributed solar power, but to make it even easier to go solar. In Minnesota’s value of solar policy (and in similar “feed-in tariff” programs in Vermont, Germany, Gainesville, etc) customers don’t spin their meter backward, they sign a 20-year (or more) contract to sell their power to the utility at a fixed price.

That contract can make financing and owning solar a lot easier, because a contract like that is much more attractive to a bank than saying, “I should be able to save a lot of money on my electric bill as long as the utility (or legislature) doesn’t change net metering and as long as utility rates continue to rise.” Net metering has been a pretty safe bet, but a contract is a safer one for a risk-averse financier.

Why Does Policy Matter?

Right now, the differences in policy are pretty small because the spread is pretty small between the (per kilowatt-hour) cost of solar electricity, the value of solar to the utility/ratepayers, and the retail energy price. It means that, taxpayer-funded incentives aside, there’s very little transfer of benefits between solar producers and non-solar customers, and the profits in going solar are relatively small. (Note: the spread varies by region and utility service territory).

But that’s going to change in a big way. In the next five years, the cost of grid electricity is likely to keep rising, the value of solar will remain relatively steady, and the cost of solar will continue falling. In that scenario, under net metering, a solar producer gets compensated for solar electricity at a price that’s much higher than its cost to produce and that exceeds its value to the rest of the utility customers. (Note: the time of arrival of this scenario varies by region and utility service territory).

The Big Question

So TASC’s solar leasing companies need to answer this question: what’s the appropriate price premium for solar energy? How much more than what solar is worth should non-solar ratepayers have to pay? A penny per kilowatt-hour? 3¢? 5¢? 10¢?

The following slideshow illustrates the forthcoming challenge:

[protected-iframe id=”6efc844e56655abb9b56af2c54c6a9b5-5104299-27880469″ info=”http://www.slideshare.net/slideshow/embed_code/33339479″ width=”427″ height=”356″ frameborder=”0″ scrolling=”no” allowfullscreen=””]

Decisions about solar policy change shouldn’t be made rashly, and net metering shouldn’t be discarded simply because an alternative exists and until it’s causing a problem. But we have an option – the value of solar – that, if implemented properly, prevents oversized payments for solar electricity with a fair and transparent price for solar energy.

If we aren’t going to change net metering, then we’d better have a good answer. Otherwise it won’t be long before the skies darken on popular support for a rooftop solar revolution.