If there’s no such thing as a free lunch, then how can Americans get solar on their roof with “zero money down” and lower their electric bill? Solar leasing, as it’s often called, is a clever market solution to poor federal and state policy design that otherwise requires Americans to do financial acrobatics to power their home or business with solar.

But solar leasing adds significantly to the cost of solar energy.

Data from the Massachusetts Department of Energy Resources published last year suggests that state taxpayers that will pay (a lot) more to make solar easy to install for individuals and businesses, and to make solar energy lucrative for solar leasing companies.

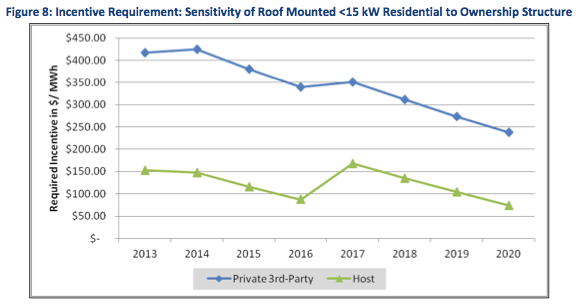

The report estimates the necessary production based incentive (in dollars per megawatt-hour of electricity produced) to support the development of solar. Specifically, the researchers priced a “10-year levelized incentive…that allows system owners to achieve their target economic rate of return.” The analysis notably focused on ownership structures, either 3rd party ownership (solar leasing) or host ownership (owned by the home or business owner). The following chart shows the difference in state incentives necessary to support a small-scale (15 kW or less) solar array that is either owned by a 3rd party or the actual electric customer.

The bottom line is that leased solar arrays require more than double the incentive needed to support customer-owned solar arrays. Not only do leasing companies require more revenue, but customers of leasing companies get less than solar owners, because they presumably sign contracts for electricity that are less than the net metering they would receive in owning a solar array.

Why does solar leasing cost more?

In the words of the report authors, “These transactions often require attracting additional tax-motivated parties to the project financing, and at considerable expense for transaction and capital.” How much more expensive? A host-owned solar array is expected to get financing at 4% interest and have a return on equity expectation of 4%. A solar leasing company is expected to pay 6% interest on shorter-term debt and to require 15% return on equity.

It might seem convenient to blame solar leasing companies for this problem, but they’re merely opportunists in a poor policy environment. Making your money back on solar in America is complicated. It requires a combination of tax savvy, skilled navigation of state bureaucracies, persistence at a local permitting office and limited options for low-cost financing. Compared to Germany, with a simple, non-nonsense long-term contract that permits low financing costs and broad participation, America’s solar market is a joke (and the installed cost of solar is much higher as a result).

Furthermore, big banks have also played a role in inflating solar leasing costs to taxpayers, using a legal loophole to collect tax incentives based on (higher) estimated costs of solar installations instead of actual costs. Leasing company SolarCity was notable targeted by the Treasury Department for its participation in the practice.

Paying twice for poor policy

In other words, we pay twice for bad solar policy in America. Complicated tax incentive, interconnection, and contract policy makes solar cost more to install than in mature markets like Germany. Solar leasing middlemen simplify the complications, but at a price premium to (complicated) individual ownership.

Even though sunshine is free, no kind of solar power is a free lunch.