This story was originally published by Canary Media and is reproduced with permission.

Small-scale renewables and batteries could team up to replace large fossil-fueled plants — it just takes a whole lot of little devices to match what big, old power plants can do.

For now, truly massive fleets of decentralized clean-energy devices, also known as virtual power plants, remain a rarity. The clean energy industry needs to deliver more proof that decentralized energy can provide reliable, clean energy on a large scale.

One company is on its way to achieving this — not an electric utility or a Silicon Valley startup, but the decades-old Japanese trading house Itochu. The company manufactures a home-battery product through subsidiary NF, then sells it with the Gridshare software developed by British startup Moixa (which was acquired by Lunar Energy last year — see Canary Media’s recent deep dive on what makes that software special). Since 2017, Itochu has quietly built up a fleet across Japan of 36,000 home batteries under its control, and that’s just the beginning.

“We want to expand to 100,000 units,” said Maiko Mori, team leader at Itochu’s Energy Storage Business Section, when Canary Media met with her on a recent visit to Tokyo.

The current contingent totals 352 megawatt-hours of storage. That aggregated storage capacity rivals some of the largest grid-scale battery plants in existence, suggesting that thousands of tiny batteries really can add up to the scale of big central power plants. At the same time, the home-battery collection runs up against the limits of the decentralized format, at least as it currently exists in Japan.

The regulations aren’t yet in place to enable all those little batteries to participate in the broader workings of the grid. So the virtual power plant is doing what it can, helping each household until the pieces fall into place for the batteries to take on a more robust role in Japan’s energy system.

The challenges Itochu has overcome offer lessons for anyone trying to build up localized clean energy portfolios. In Japan, just like any other region trudging toward a cleaner, more decentralized energy system, the progress thus far only illustrates how much more is possible.

The limits of the virtual power plant today

Itochu’s world-class virtual power plant remains limited in scope because, as Isshu Kikuma, Japan analyst at energy research firm BloombergNEF explained, “the government doesn’t allow power sources connecting at a low-voltage grid to export power to the grid under the current regulation.”

That leaves Itochu’s battery fleet caught at an intermediate stage of evolution.

“It’s a massive fleet of batteries,” said Chris Wright, who co-founded Moixa and now serves as SVP of software tech at Lunar Energy. But, he added, “We’re not dispatching them in aggregate as a virtual power plant right now. […] This is all behind-the-meter optimization.”

That means that Itochu’s fleet can’t deliver some of the most lucrative and valuable services for the broader power grid, such as maintaining the right frequency for the wires to operate properly or delivering electricity at moments of high demand. Granted, not many places around the world have figured out how to incorporate small, local batteries into macro-level grid operations. But Germany and parts of the U.S., for instance, have shown it can be done effectively.

In place of paying customers for their services to the grid, Itochu has made do with saving them money by smartly managing their solar production and arbitraging power by storing it at times when it costs less and dispatching it at times when it costs more.

“Right now, Gridshare is working for the customer’s economical benefits, but it could work for the power company as well,” Mori said.

Lunar Energy’s Head of Software Product Sam Wevers put a number on those benefits: “We add 14 percent additional savings beyond the battery’s default mode,” he said. Batteries come from the factory with settings to maximize consumption of a household’s solar production or optimize around time-varying rates, which apply to most battery customers in Japan. But Gridshare internalizes each home’s consumption patterns and anticipates 48 hours into the future; the AI calculations figure out strategies that a default setting isn’t capable of, Wevers said.

That’s enough savings for Itochu to market a competitive edge in the battery-vendor landscape. But more roles for the fleet could be forthcoming. The latest word from the government is that rules for distributed-energy participation in large-scale grid services will go live in 2024, Wright said. “It’ll come online soon enough,” he said; once that happens, Itochu’s fleet can play a “nationally important” role in Japan’s grid-decarbonization efforts.

Why does Japan need a virtual power plant?

For a virtual power plant to amount to more than confusingly worded grid jargon, it needs to solve a tangible problem for someone. In Japan, like elsewhere, the looming challenge is how to decarbonize the grid without sacrificing reliability, and virtual power plants can help.

Japan’s isolated island grid relies on imported fossil fuels for all the electricity it can’t generate with nuclear or renewables. But Japan cut back on nuclear production after the Fukushima disaster. And renewables are more expensive to build there than in many other countries because of limited available land and rugged, mountainous terrain, said Kikuma, the BNEF energy analyst.

“Rooftop solar has a huge potential due to Japan’s land constraint,” Kikuma noted.

Starting in 2009, households in Japan that installed rooftop solar could get paid for the power the system exported to the grid via a generous feed-in tariff. But that payment scheme only lasts for 10 years from the date of enrollment, so the first wave of adopters began rolling off the program in 2019, after which they started earning much less for sending power to the grid.

Annual residential solar installations have declined slightly since the 2019 peak of 1,165 megawatts, but the sector still added 1,000 megawatts or more in both 2021 and 2022, according to BNEF data. That’s a robust market, but every year, more households with rooftop solar find themselves losing the feed-in tariff and needing a new plan to make the most of their power production.

Japanese customers had already been interested in batteries as a backup power source in case of outages from the various disasters that periodically strike the country — most acutely, earthquakes and typhoons. But the loss of the feed-in tariff makes batteries attractive for economic reasons too, to enable using more rooftop solar generation outside of the sunny hours.

Residential battery installations have risen steadily over the last five years, according to BNEF data. In 2022, Japanese households added 313 megawatts and 877 megawatt-hours, making this one of the most active home-battery markets in the world. In fact, BNEF’s numbers show that Japan installed far more home-battery capacity annually than all of the U.S. from 2017 through 2020; the U.S. market finally overtook Japan in 2021.

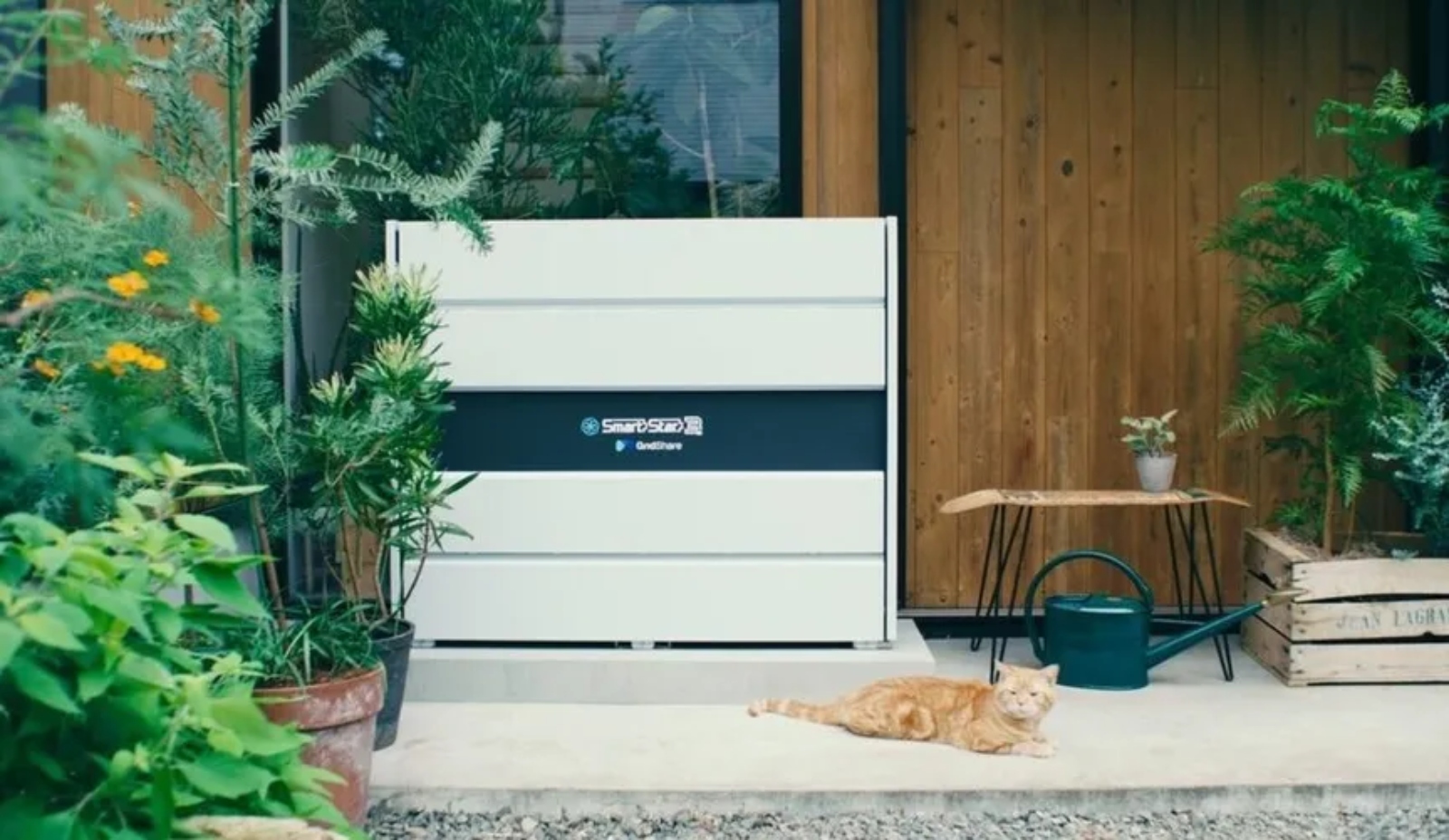

Itochu has capitalized on this trend. Its subsidiary NF manufactures models of the Smart Star battery pack with 9.8 kilowatt-hours or 13.1 kilowatt-hours of storage capacity. It comes AC-coupled, which makes it easier to attach to Japan’s many existing rooftop solar installations. Smart Star has sold 55,000 units in Japan, mostly going to Itochu’s fleet.

A virtual power plant, then, provides economic justification for the small-scale clean energy that Japan desperately needs, given how tricky it is to build large-scale clean energy there. If batteries eventually start taking over roles currently served by fossil-fueled plants, they will further reduce the need for carbon-emitting imported fuels. That looks all the more attractive given the global scramble for fossil gas imports in the aftermath of Russia’s invasion of Ukraine.

“The energy-security argument in Japan is very powerful, for various geopolitical reasons,” Wevers noted.

Lessons from Itochu’s massive virtual power plant

Still, it takes thousands of houses with batteries to add up to the capacity delivered by a typical gas-fired power plant. For virtual power plants to live up to their name and their promise, they need to operate on a massive scale.

Few initiatives have come close to that. One of the longest-running American VPPs, controlled by Vermont utility Green Mountain Power, had more than 4,000 home batteries participating as of last summer. The unexpectedly prolific, utility-led Wattsmart program in Utah enlisted 3,000 homes in just a couple of years. A new virtual power plant pilot program in Texas could end up with far more than that across the state, but it’s still getting started.

German home storage company sonnen has gotten further, with 120,000 battery units installed around the world; the bulk of that is in Germany, where the company operates its fleet like a decentralized utility, performing grid services and supplying customers with power at cheaper rates.

Virtual power plants, then, are still in a nascent stage globally, and the constitutionally conservative utility industry tends to resist new concepts and technologies until there’s no way to ignore them any longer. What Itochu learned early on is that it couldn’t wait for other power industry players to sign on; it had to go build the thing on its own.

“At first, nobody was interested in this,” Mori said. “But we scaled to 36,000 [units]. We have deployed these batteries — [power companies] can use them at their convenience.”

In other words, now that Itochu has the capability built and ready to use, more traditional providers are taking notice. Itochu is working with electricity retailers, including Tepco, Chubu, Kyushu, and Tohoku, to prove that its battery fleet can respond predictably and reliably enough to save those companies money.

It’s those companies’ job to source enough power for their customers at all times. But at some times of day, it’s simply more expensive to buy or produce power. Using batteries to arbitrage between expensive and cheap hours reduces the cost of keeping customers’ lights on, and that’s attracting attention from Japan’s power providers, especially as electricity costs have risen.

These power companies could eventually buy the batteries themselves and lease them to households; this would give customers the benefits they want without the big upfront expense, while giving the companies more direct control of the equipment for their own uses.

“We want to change the energy business,” Mori said. “The virtual power plant could make the Japanese energy business more resilient and bring benefits to all the parties.”