This story was originally published by Canary Media and is part of its special series “The Tough Stuff: Decarbonizing steel, cement and chemicals.”

Holcim Group, the largest cement manufacturer outside of China, has a dilemma.

On the one hand, its line of business couldn’t be more solid — cement is, after all, one of the building blocks of the modern world. But producing the material emits enormous amounts of planet-warming carbon dioxide, surpassing the emissions of every country in the world except China and the U.S. These days, the Swiss company, like its handful of global cement manufacturing peers, is feeling increasing pressure to do something about it.

Holcim has managed to chip away at its emissions in recent years: Its 2022 annual report cited a 21 percent reduction in carbon emissions per unit of net sales from direct production and electricity consumption compared to the year before. The company has made progress largely because of a shift to lower-carbon cement and concrete products that reduce its use of clinker, the precursor material for cement, and by far the most emissions-intensive part of the industry. Crucially, costs have actually dropped along with emissions, the company says.

Its most recent step came just last week with a $100 million investment in its biggest U.S. cement plant that will increase production capacity by 600,000 metric tons per year while cutting carbon dioxide emissions by 400,000 tons per year.

“What we’re doing today is based on economics,” Michael LeMonds, Holcim’s U.S. chief sustainability officer, told Canary Media.

But not every solution to cement’s climate problem will present companies with such a clear-cut economic calculus. And while the U.S. Department of Energy estimates that more than a third of the industry’s emissions can be jettisoned using established technologies and processes like clinker substitution, the remainder of the solutions have yet to come into full focus.

Most uncertain of all is the pathway to eliminating what are called “process emissions,” which account for the majority of cement’s climate problem.

Process emissions are an unavoidable part of cement-making’s status quo. The core input of ordinary Portland cement — the product that makes up the vast majority of cement made today — is limestone, a mineral that’s about half calcium and half carbon and oxygen by chemical composition. When that limestone is converted to calcium oxide, the immediate precursor to clinker, the CO2 trapped inside the mineral is released into the atmosphere.

Eliminating these emissions means either finding novel, emissions-free ways to create ordinary Portland cement or a safe structural equivalent, or figuring out how to economically use carbon capture, utilization, and sequestration, or CCUS, technology to keep the CO2 generated from the manufacturing process from entering the atmosphere. Though plenty of startups, companies and researchers are hard at work on both methods, neither has, at this point, proven to be workable at the necessary scale. For Holcim, CCUS is “the number one midterm objective” for the company’s carbon-cutting ambitions, according to LeMonds.

Holcim’s current situation — publicly touting progress on near-term carbon-cutting tactics like clinker substitution while working toward an uncertain solution for slashing process emissions — provides a snapshot of where many of the world’s biggest cement and concrete companies are today on their path toward decarbonization. The lower-carbon solutions that make economic sense right now, and which are minimally disruptive, are gaining traction, but the progress they offer is incremental; they’re not enough to get to zero emissions.

For Holcim and the industry at large, dealing with process emissions — and eliminating carbon emissions completely — will require nothing short of a full transformation.

A blueprint for action

Change at the scale required for the cement industry won’t come cheap, or fast.

In the U.S., which produces just a fraction of the world’s cement, the industry will need to invest up to a cumulative $20 billion by 2030, and a total of somewhere between $60 billion and $120 billion by midcentury, according to DOE estimates. That’s a lot for an industry that made just under $15 billion in sales last year, and the necessary outlays are made more daunting by the fact that cement companies compete on razor-thin margins.

But even if the money wasn’t a problem, there would still be the other imperative to deal with: product quality. If cement-makers can’t prove beyond a shadow of a doubt that their newly introduced products are as reliable as what they’re replacing, their customers will reject them, according to Ian Hayton, the senior associate leading materials and chemical research at Cleantech Group.

All of these factors make the cement industry “very slow” to change, Hayton said. “There’s lots and lots of infrastructure already deployed. It’s not just about finding the best way. […] You have to start to think about what we already have in place.”

But as with all major climate problems, moving slowly is a luxury that the world simply does not have.

“It’s really important for people to be moving fast,” Vanessa Chan, chief commercialization officer and director of DOE’s Office of Technology Transitions, told Canary Media. “Oftentimes, people think we can’t do this because the technology isn’t there. I think people should know that 30 to 40 percent of emissions can be abated from technologies that are ready today.”

What’s more, those near-term technologies will help the cement industry’s bottom line, she said. While they’ll require from $3 billion to $8 billion in capital investment to put in place, they also offer an estimated $1 billion per year in savings by 2030.

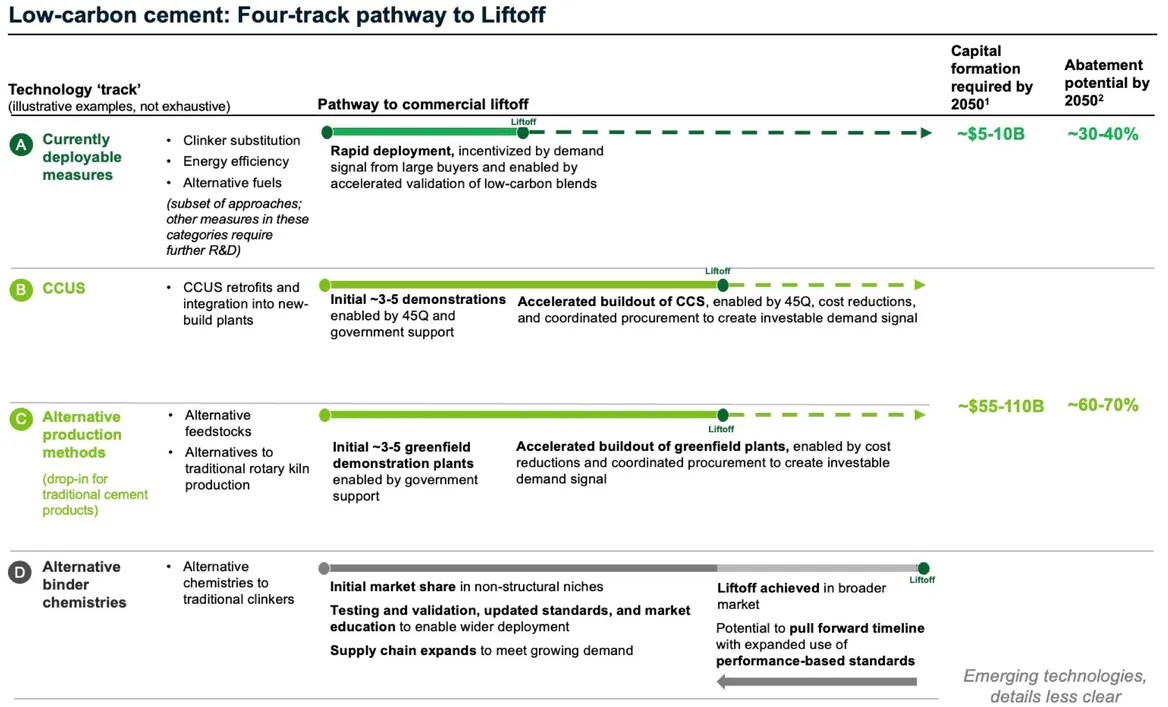

This chart from DOE’s recent Liftoff Report on cement decarbonization highlights both the short-term solutions available and the costly and long-term challenge of zeroing out emissions.

“These are technologies” that cement companies “could do right now if they could embrace them,” Chan said.

That “do right now” list includes the clinker substitution Holcim is already having success with, but also changes to the fuel sources that power cement production.

The U.S. cement industry has already cut its emissions-intensity per metric ton of cement by roughly 10 percent since 1995, largely by replacing coal and coke with fossil gas, the DOE’s report states. Swapping gas for alternative fuels can offer an additional 5 to 10 percent emissions reduction potential through 2030, starting with burning waste-based fuels (e.g., old tires) like those Holcim is already using to nearly replace fossil fuel use at plants in Ohio and South Carolina, according to LeMonds.

But for these alternative fuels, “abatement potential is limited and deployment comes with supply and environmental constraints,” the DOE’s report points out. And the large-scale replacements for fossil fuels — clean electricity and hydrogen — are far off in both technical and cost terms. Even with the Inflation Reduction Act’s lucrative tax credits, clean hydrogen “may be prohibitively expensive,” while electrification technologies remain “technologically nascent and have uncertain but likely challenging economics.”

Another option available right now is to retool cement plants to be more efficient, which Holcim is also doing to clean up the 1,500-degree-Celsius kilns it uses to make clinker.

But of these ready-to-go solutions, clinker substitution carries the most promise; it’s already delivering the majority of the industry’s emissions reductions. And although the approach isn’t enough to decarbonize cement production on its own, accelerating this practice could deliver huge near-term progress simply by slashing the amount of Portland cement needed for every unit of cement used in construction around the world.

The science and economics of cement substitution

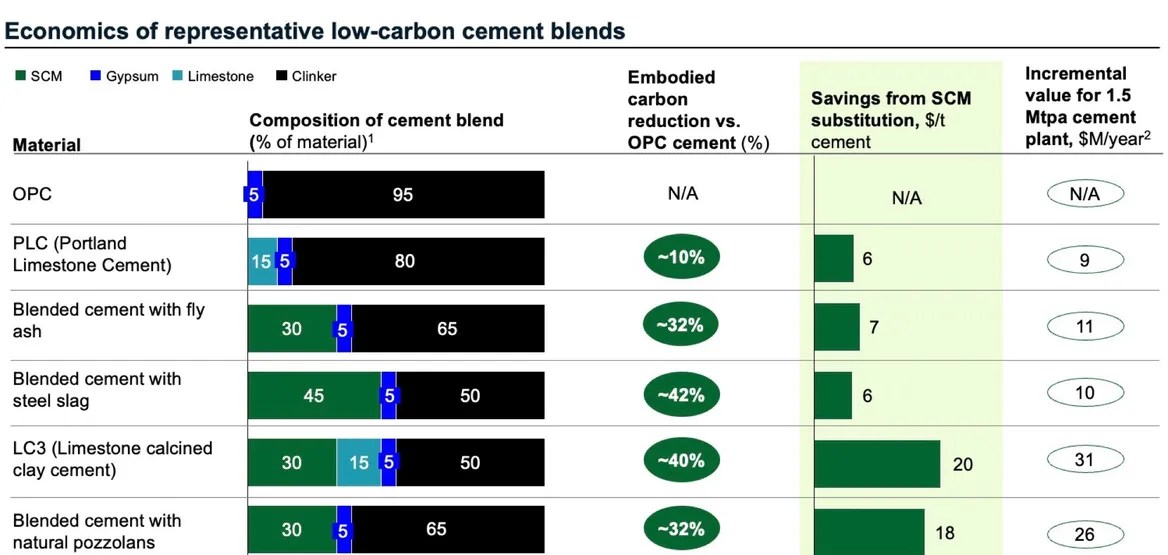

The math is fairly simple on clinker substitution: The greater the amount of clinker that’s substituted with another material, the lower the carbon footprint per ton of cement that results.

By far the most widely adopted substitute is “Portland limestone cement,” which replaces up to 15 percent of clinker with ground-up limestone. Because that ground-up limestone hasn’t been processed in a way that releases its embedded carbon dioxide, this variety of cement yields an average 8 percent reduction in emissions-intensity compared to ordinary Portland cement. PLC has been in wide use in Europe for decades but has only in the last three years caught on in the U.S.

“In just a couple of years, we’ve seen PLC go from 3 percent of the market” for U.S. cement sales “up to a substantial amount — 35 percent in 2023,” said Rebecca Dell, who directs the industry program for the ClimateWorks Foundation.

That statistic highlights both the slow-to-change nature of the cement industry — PLC was approved under a widely used industry standard in 2012, but took another eight years to grow from 2 percent to 3 percent of U.S. production — and the potential for quick adoption once cost and standards compliance drivers align.

“There are places in the United States where there’s a shortage of cement,” she noted. If cement-makers can add other materials to the cement they sell and incrementally relieve that shortage, “why wouldn’t you do that?”

The same logic applies to a long list of supplementary cementing materials that can displace clinker and make up 30 to 45 percent of a cement mix. By far the most commonly used today are fly ash from coal plants and slag from steel mills.

The problem with these materials, according to Samuel Goldman, policy advisor at DOE’s Loan Programs Office, is that they are byproducts of current-day manufacturing processes in heavily emitting industries. In a fossil-free future, “they are not going to be available in the amounts required,” Goldman said.

That means “the key to deploying clinker substitution at scale and keeping the economics positive are moving toward what we call next-generation substitutes,” Goldman said.

One promising “next-gen” substitute is calcined clays, a form of naturally occurring minerals used by companies such as Heidelberg Materials and Hoffmann Green Cement Technologies. The technology for using these minerals to replace up to half of the clinker in cement was developed by the Swiss Federal Institute of Technology, a government research institution that’s made the processes freely available for use, noted Dell of the ClimateWorks Foundation.

“It’s fully technologically mature, it saves money, it uses commonly available materials, and it can reduce greenhouse gases by up to 40 percent,” she said.

Other next-gen supplementary cementing materials, or SCMs, involve commonly available calcium silicate rock such as basalt, gabbro, and other minerals. Because these rocks contain no carbon, they can be processed without releasing CO2. Breakthrough Energy, the Bill Gates–founded cleantech investment organization, has invested in Terra CO2, a startup that’s processing calcium silicate rock into SCMs being tested in roadways and buildings today, and Brimstone, a startup that plans to produce both Portland cement and SCMs from its proprietary process.

Patrick Cleary, Holcim’s senior vice president of U.S. cement sales, highlighted another approach: treating and using the coal-plant fly ash that has already been deposited into enormous holding ponds, which are significant environmental and health hazards in their own right.

“We take a material that’s been buried that has to be dealt with…and put it through our process, and it becomes a product that has cementitious properties,” he said. Holcim announced its first fly-ash pond recovery project with Alberta, Canada–based energy company TransAlta in January, and it hopes to expand such projects in the U.S., he said.

New cements, new processes — a steeper path to progress

Reducing clinker use and working lower-carbon SCMs into cement mixes can have a major impact now — but outright replacing or revamping the production of ordinary Portland cement is what the industry needs to eventually reckon with.

There are dozens of startups and university and government research projects working to come up with alternatives to ordinary Portland cement. Some are even engaged in pilot-scale demonstrations. But none have yet been embraced by the cement industry as a viable option for revamping a single integrated cement manufacturing plant — the first step to potentially overhauling the entire industry.

The challenge is that the chemistry of cement and concrete — the mix of cement and rocks, gravel and other materials that harden into forms and slabs — is incredibly complex, said Ryan Gilliam, CEO of alternative cement startup Fortera. While Portland cement is well understood, “there are still fundamental debates among scientists” on the nature of the chemical reactions that yield better or worse forms of concrete from different types of cement for use in different applications, he said.

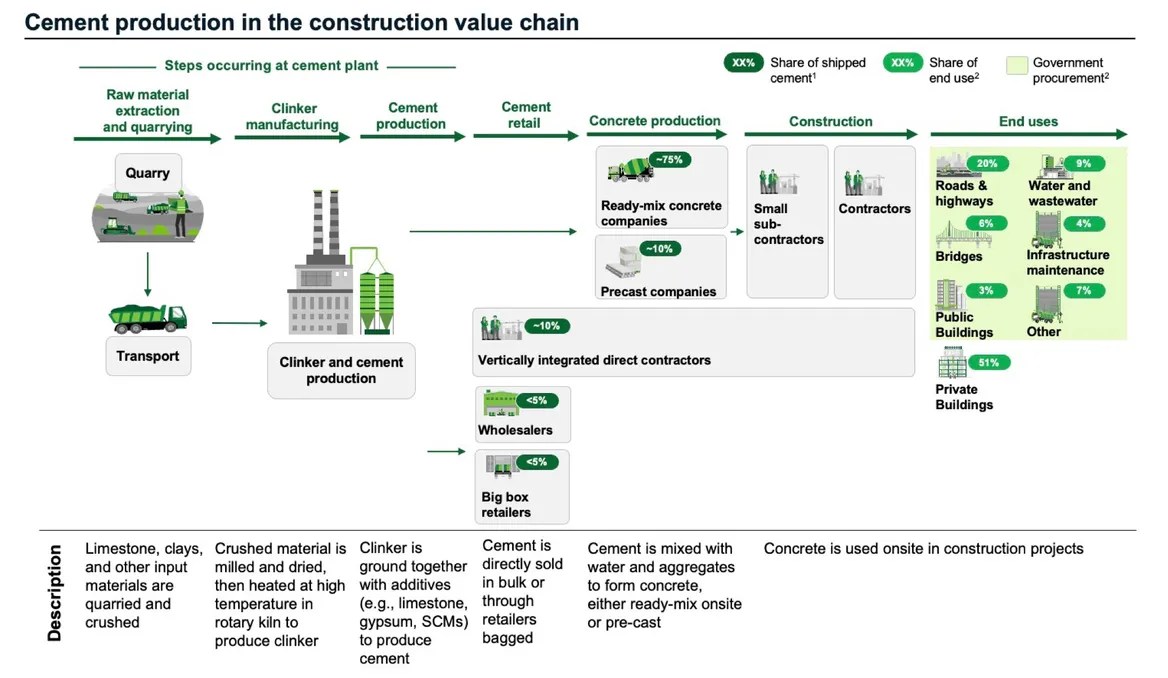

Meanwhile, the industry has become more fragmented in recent years, moving from large centralized cement manufacturing to a more diverse lineup of smaller ready-mix and precast concrete operations that serve a multitude of end users. Each party in this chain relies on being able to secure consistent supplies and types of products for different needs, with an array of different standards that are difficult to alter to allow for new products to get to market.

Plus, as Dell noted, the original patent for ordinary Portland cement was issued in 1824, giving the world nearly 200 years to understand its fundamental material properties.

“If you can make something that’s chemically identical to ordinary Portland cement but from different rock, you can port over those two centuries of experience in how it behaves and its structural capacity,” she said. But “people are going to be risk-averse, and it’s going to take a long time to get market uptake.”

These conditions make for an uphill climb for startups trying to bring new cement processes and chemistries to market.

For its part, Fortera’s alternative cement is based on technology first developed back in the 2000s to mimic the process that leads to growth in coral reefs, but it’s just one of many contenders. Others include geopolymer chemistries like Cemex’s Vertua low-carbon concrete, magnesium oxides derived from magnesium silicate chemistries developed more than a decade ago by now-defunct U.K.-based startup Novacem, and the belite-ye’elimite-ferrite clinker being developed by Holcim.

Some methods for reinventing cement aim to forgo the high-temperature kilns altogether in favor of electrochemical processes. Sublime Systems and Chement are developing ways to use electrolyzers, like those used to make hydrogen from electricity and water, to dissolve and then extract the precursor compounds that make up cement.

These novel technologies could be key to eliminating cement emissions; replacing carbon-intensive Portland cement with a low- or zero-carbon alternative is about as close to a silver bullet as the industry can hope to get.

But due to the industry’s cautiousness, any alternative binder would likely take a decade or more to gain acceptance, according to the DOE. “Though they can build initial market share and scale in non-structural niches” — applications like sidewalks and concrete floors that don’t need to hold up immense weight— “these materials could face a ~10–20+ year adoption cycle to be accepted under widely used industry standards,” per the report.

That’s why DOE sees an earlier opportunity for finding new, lower-carbon ways to make traditional Portland cement, instead of creating entirely new cements altogether.

There’s only a relatively small fraction of the cement market that can be replaced by alternative cements — “maybe at most 25 percent of the cement market,” according to Cody Finke, CEO of Brimstone, whose company is making a product that’s structurally and chemically identical to Portland cement. “We want to decarbonize the whole cement industry.”

It’s a worthwhile approach, but one that also remains far from guaranteed. Brimstone, the only startup to win industry approval that its alternative process results in ordinary Portland cement, is planning to build a pilot plant in Nevada to test its production methods before building a commercial-scale facility. Finke noted that the company hasn’t yet taken any strategic investment from the cement industry. “There’s a right time for that,” he said — and “the right time is after we de-risk the process.”

Carbon capture: The cement industry’s major focus comes with big challenges

These challenges with alternative cements and production methods have led many analysts to conclude that the fastest path to cutting cement’s carbon impact lies in simply capturing the carbon emitted through the ordinary Portland cement process.

DOE’s Liftoff Report cites cement-industry and third-party studies that suggest that carbon capture, utilization, and sequestration, or CCUS, could account for more than half of the industry’s carbon-emissions reduction potential by 2050 “in the absence of alternative approaches.”

The Global Cement and Concrete Association has identified more than 30 cement CCUS projects worldwide, most of them in Europe. Europe is also the home of the largest heavy industrial carbon-capture project now under construction, the Heidelberg Materials cement plant in Brevik, Norway. The carbon capture and storage, or CCS, facility is on schedule to start capturing and storing 400,000 metric tons of CO2 per year by the end of 2024.

“That’s not a pilot project,” Dell said. “The thing they’re doing in this facility is the simplest thing you can do, which is post-combustion CO2 capture. They’re not doing anything fancy — but they’re doing it at scale.”

In the U.S., by contrast, cement CCUS projects are just entering the exploratory stage. The DOE is working on four cement CCUS projects, including a Cemex plant in Los Angeles, a Heidelberg plant in Mitchell, Indiana, and two projects with Holcim at plants in Florence, Colorado and Bloomsdale, Missouri.

CCUS is attractive for an industry seeking decarbonization pathways that don’t require rebuilding existing manufacturing plants, Cleantech Group’s Hayton noted. “You can put a unit on the back of your clinker production site and start to separate out the carbon dioxide from what’s coming out of the flue,” and then “concentrate it down and store it, hopefully somewhere underground.”

But CCUS still presents the same challenges for the cement industry as it does for everyone else: high upfront capital costs for the equipment to separate CO2 and the high energy costs to keep that equipment running. For the cement industry, that could equate to $25 to $55 per metric ton of cement produced, DOE’s Liftoff Report estimates.

The Inflation Reduction Act’s carbon-capture tax credits of up to $85 per metric ton of carbon captured and stored from emissions sources could help make this a cost-effective option. But even with that in place, there’s the cost of transporting and storing the captured CO2. Notably, the biggest U.S. cement CCUS projects have potential access to underground geological formations that are suitable for holding large amounts of captured CO2 for centuries.

One workaround to the latter issue is using captured CO2 instead of storing it — the U in CCUS. Cement and concrete can absorb and store CO2 at the timescales required for effectively keeping it from entering the atmosphere. There’s also evidence it can strengthen concrete. These facts have spawned a wide array of startups with technologies to do just that.

Some are injecting CO2 into concrete as it’s poured or formed into precast shapes, such as CarbonCure, CarbonBuilt, and Solidia. Others are expanding into using captured CO2 in the cement-making process itself, such as Fortera and Leilac.

While the CO2 these companies are embedding in concrete isn’t being pulled directly from the emissions from cement production today, it could be in the future, CarbonCure CEO Robert Niven said. His company recently unveiled the results of a project with direct air capture company Heirloom.

“Yes, for the volume, we’ll need to do some geological storage” of CO2 captured from cement production, he said. “But why wouldn’t you use some of the CO2 from that value chain…to make products you can sell to the market to create real value-added impacts?”

Driving demand for greener cement

So far, this discussion of decarbonization opportunities and challenges for the cement and concrete industries has focused on the supply side of the equation. But that’s only half the battle. Cutting carbon from these industries will also require what DOE’s Liftoff Report calls “demand signals” — clear mandates and incentives from cement buyers that reward the investments and risks they’ll be taking.

After all, even if a perfect carbon-free replacement cement product or process comes along tomorrow, cement manufacturers have to take on the risk of retooling or building brand-new cement plants. That’s an expensive endeavor: A new U.S. cement plant requires between $500 million and $1 billion in capital investment, DOE’s Liftoff Report states. Most of these plants are financed on cement company balance sheets, rather than via project-financing mechanisms that have helped bring down the cost of large-scale energy projects over the past few decades.

Without a policy push, major cement companies are simply not going to take on that risk. Governments could nudge cement producers in that direction with a stick, like a carbon tax, or as DOE’s Vanessa Chan pointed out, with the carrot of government procurement.

“Half of U.S. cement demand is driven by federal and state procurement,” she said. Anything that governments do to encourage or require cement producers to meet lower-carbon standards to serve these contracts will have a major impact.

In the U.S., the Biden administration’s Buy Clean Initiative is starting to set standards for this lower-carbon purchasing. Last year, the General Services Administration, which oversees about $75 billion in annual contracts, announced new “low embodied concrete” standards that require contracts for projects funded by last year’s Inflation Reduction Act to secure cement and concrete with lower carbon emissions footprints than national averages.

Similar low-carbon concrete initiatives have been created in states including New York, New Jersey and California, Hayton noted. Private-sector efforts are also underway. Groups including the ConcreteZero initiative have aligned construction and engineering firms and property owners to set voluntary standards to buy and use lower-carbon cement and concrete.

But the trick is to get cement and concrete producers and buyers on the same page, Chan said.

“Oftentimes, you see that you can’t get people to create new technologies until there’s an offtake agreement — and you can’t get that offtake agreement until there’s a stable supply chain.”

That’s why it’s so important for policymakers to set incentives and standards not just for cement producers, but for buyers as well, Dell said.

“If you can pull these clean materials through the supply chain, you can do it in a way that does not materially affect the finished cost, but can supply significant green premiums — if you like that term — to the producers.”