Cross-posted from Climate Progress.

There’s a joke in the solar industry about when “grid parity” — the time when solar becomes as cheap as fossil sources — will happen. Ron Kenedi, the former VP in Sharp Solar’s U.S. business liked to throw out random dates, telling me once “November 21, 2012” in jest.

The truth is, it will happen in phases — one market and one technology at a time.

But according to two top solar executives — Tom Dinwoodie, chief technology officer and founder of SunPower and Dan Shugar, former president of SunPower and current CEO of Solaria — “ferocious cost reductions” are accelerating that crossover in a variety of markets today.

Dinwoodie and Shugar are responsible for developing over $3 billion in photovoltaic (PV) projects around the world. They were making the rounds in Washington this week, giving presentations to journalists and policymakers about the changing economics of solar PV. Joining them was Adam Browning, the executive director of the Vote Solar Initiative, an organization responsible for much of the state-level progress for solar in the U.S. (Vote Solar helped put together the data.)

Their goal: to explain that solar PV is no longer a fringe, cost-prohibitive technology — but, rather, a near-commodity that is quickly becoming competitive with new nuclear, new natural gas, and, soon, new coal.

These slides are a must-see for anyone interested in solar, or in the business of energy generally. While I think some of the predictions and comparisons between technologies aren’t telling the full picture, the underlying data is very compelling: We are starting to realize grid parity in solar — all with technologies available today.

Let’s take a look.

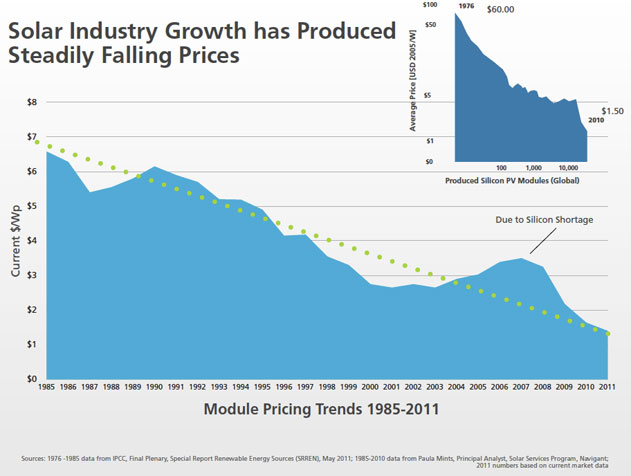

Notice in the first chart how steadily manufacturing costs have come down, from $60 a watt in the mid-1970’s to $1.50 today. People often point to a “Moore’s Law” in solar — meaning that for every cumulative doubling of manufacturing capacity, costs fall 20 percent. In solar PV manufacturing, costs have fallen about 18 percent for every doubling of production. “It holds up very closely,” says Solaria’s Shugar.

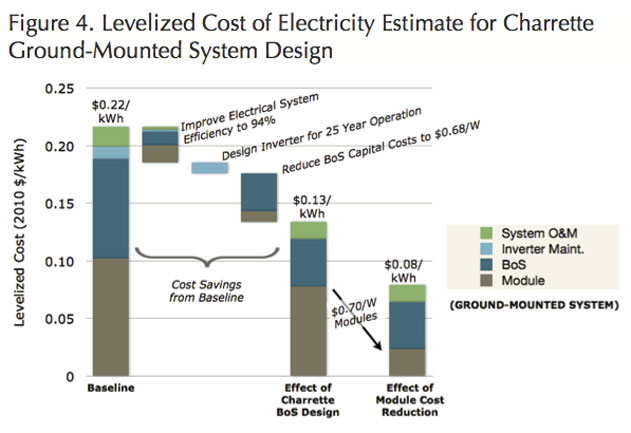

The “Moore’s Law” analogy doesn’t necessarily work on the installation side, as you have all kinds of variables in permitting, financing, and hardware costs. But with incredible advances in web-based tools to make sales and permitting easier; new sophisticated racking, wiring, and inverter technologies to make installation faster and cheaper; and all kinds of innovative businesses providing point-of-sale financing (think auto sales), costs on the installation side have fallen steadily as well. The Rocky Mountain Institute projects that these costs [PDF] will fall by 50 percent in the next five years. (Note: This chart is from RMI, not from the Dinwoodie/Shugar presentation.)

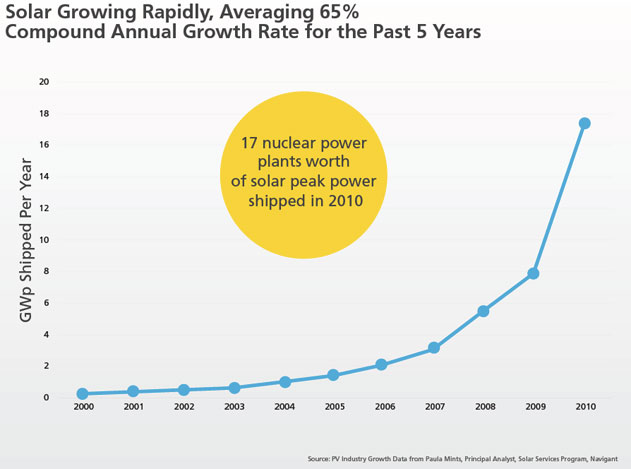

What has driven these cost reductions? A staggering ramp-up in installations around the world that have driven an even greater increase in solar manufacturing. (By the end of this year, GTM Research predicts we’ll have 50 gigawatts of module global production capacity.)

As SunPower’s Dinwoodie puts it:

That 17 gigawatts installed in 2010 is the equivalent of 17 nuclear power plants — manufactured, shipped, and installed in one year. It can take decades just to install a nuclear plant. Think about that. I heard Bill Gates recently call solar “cute.” Well, that’s 17 gigawatts of “cute” adding up at an astonishing pace.

He has an excellent rhetorical point, which highlights the brilliance of solar: This modular technology can be produced and installed at a pace far faster than most energy technologies. And businesses are getting amazingly efficient at doing so.

However, this comparison neglects the “value” of energy. Nuclear is a baseload resource; solar PV is more of a “peaking” resource. To compare 17 gigawatts of global solar PV development to 17 gigawatts of nuclear power plants ignores the fact that nuclear produces far more electricity than an equivalent solar PV plant.

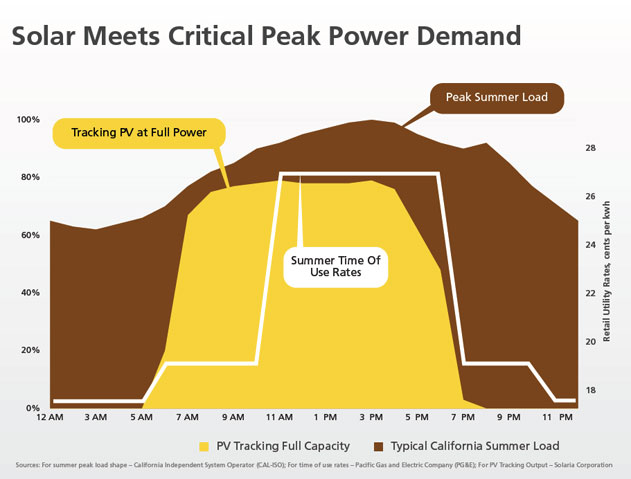

With that said, solar brings a different kind of value to the grid. Not only can it be quickly deployed on existing infrastructure (warehouses, commercial buildings, residences) at rates that are orders of magnitude faster than nuclear, it offsets the most expensive peaking power plants — providing immediate economic value.

Here’s an amazing statistic told by Shugar: If only 500 megawatts of solar PV had been deployed in the northeast U.S. to help alleviate demand for electricity, the August 2003 U.S.-Canadian blackout wouldn’t have happened. That blackout was the second largest in the world, causing between $7 and $10 billion in economic damage.

Notice in this chart how beautifully solar PV fits in to the highest demand periods in the middle of the day:

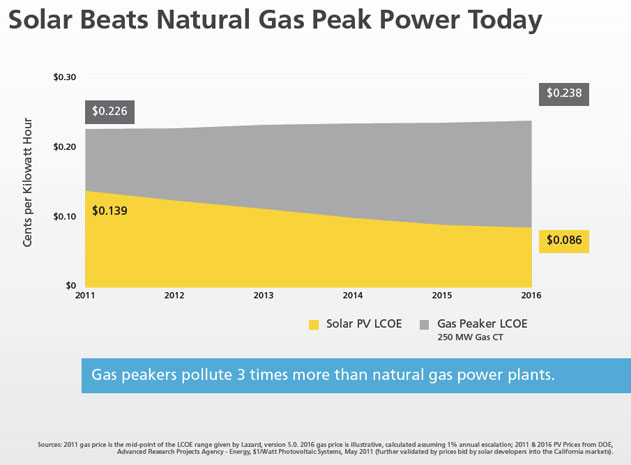

“We are considerably lower than natural gas peaker plants,” says Dinwoodie. “We’re also coming in lower than new nuclear and becoming lower than new coal. Gigawatts of these plants are being developed in months — not years or decades.”

Here’s their comparison between solar PV, natural gas peakers, nuclear, and coal. The figures come from Lazzard, an international financial services firm that tracks energy data, and the Department of Energy.

You can see that natural gas peaker plants, which sit idling most of the day, are an expensive option for utilities:

In sunny markets like California, solar is becoming competitive with large combined-cycle natural gas plants as well. According to Dinwoodie, there have been 4 gigawatts of contracts for solar PV plants in California signed below the Market Price Referent — the projected price of a 500-megawatt combined cycle natural gas plant.

While that is a major milestone for the solar industry, we need to be careful about jumping to conclusions based on these figures. Some in the solar business fear that many developers are signing contracts too low — which means they get the contract, but investors may be hesitant to provide financing because they’re concerned the projects won’t pencil out. But the trend is clear: Continued declines in the cost of building solar plants is allowing developers to compete with fossil energies in certain markets.

Here’s another important statistic: When SunPower built the 14-megawatt Nellis Air Force Base system in 2007, it cost $7 per watt. Today, commercial and utility systems are getting installed at around $3 per watt. In 2010 alone, the average installed cost of installing solar PV dropped 20 percent.

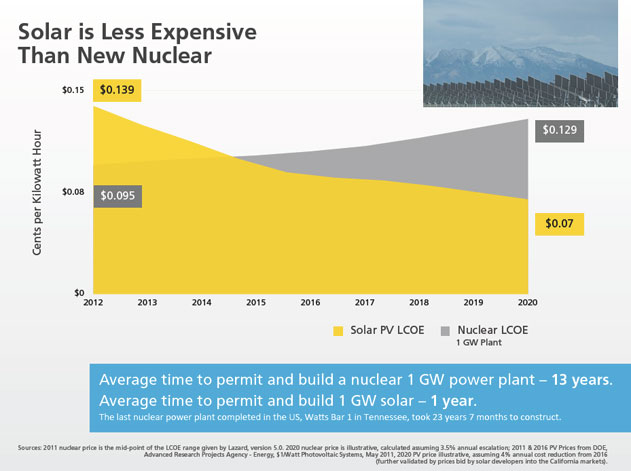

It would appear that solar PV is also cheaper than new nuclear:

This year, the U.S. industry may install 2 gigawatts of solar. The last nuclear power plant to come online in the U.S., Watts Bar 1, has a capacity of 1.1 gigawatts — but that took 23 years to complete, not two years.

When looking at the time and cost of construction of new nuclear — as well as insurability issues — solar PV (in sunny areas) is already competitive with those plants. Again, I believe there is a big difference in the “value” of electricity from nuclear and solar PV given that they play such opposite roles; but these figures do tell an interesting story. (These figures were put together before the Fukushima accident.)

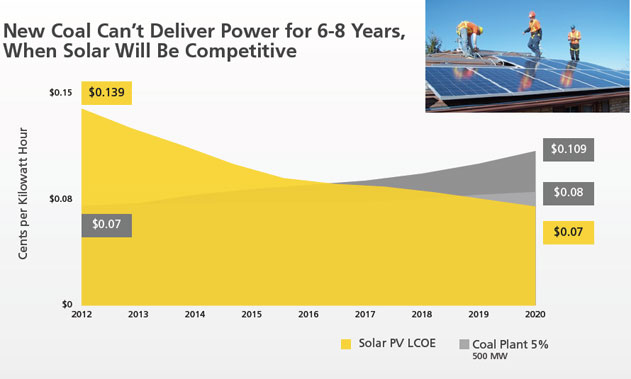

And what about coal — supposedly our cheapest form of energy? Dinwoodie and Shugar argue that solar PV is becoming competitive against that technology too:

Over the last few years, 153 coal plants have been abandoned, in large part due to uncertainty over environmental regulations. Dinwoodie and Shugar believe that by the time a new American coal facility is built in the next six years, solar PV in the sunniest regions can be competitive with those plants.

Again, we have to recognize the differences in energy value. Resources like biomass combined-heat-and-power, geothermal, and hydro may be better equipped to make up for the loss of coal. But if these projections are accurate — and experience suggests they are on target — getting solar PV competitive with coal would be a huge boost to the industry.

So what does all this mean? It means that the notion that “solar is too expensive” doesn’t hold up anymore. When financing providers can offer a home or business owner solar electricity for less than the cost of their current services; when utilities start investing in solar themselves to reduce operating costs; and when the technology starts moving into the range of new nuclear and new coal, it’s impossible to ignore.

According to SunPower’s Tom Dinwoodie: “The cross-over has occurred.”